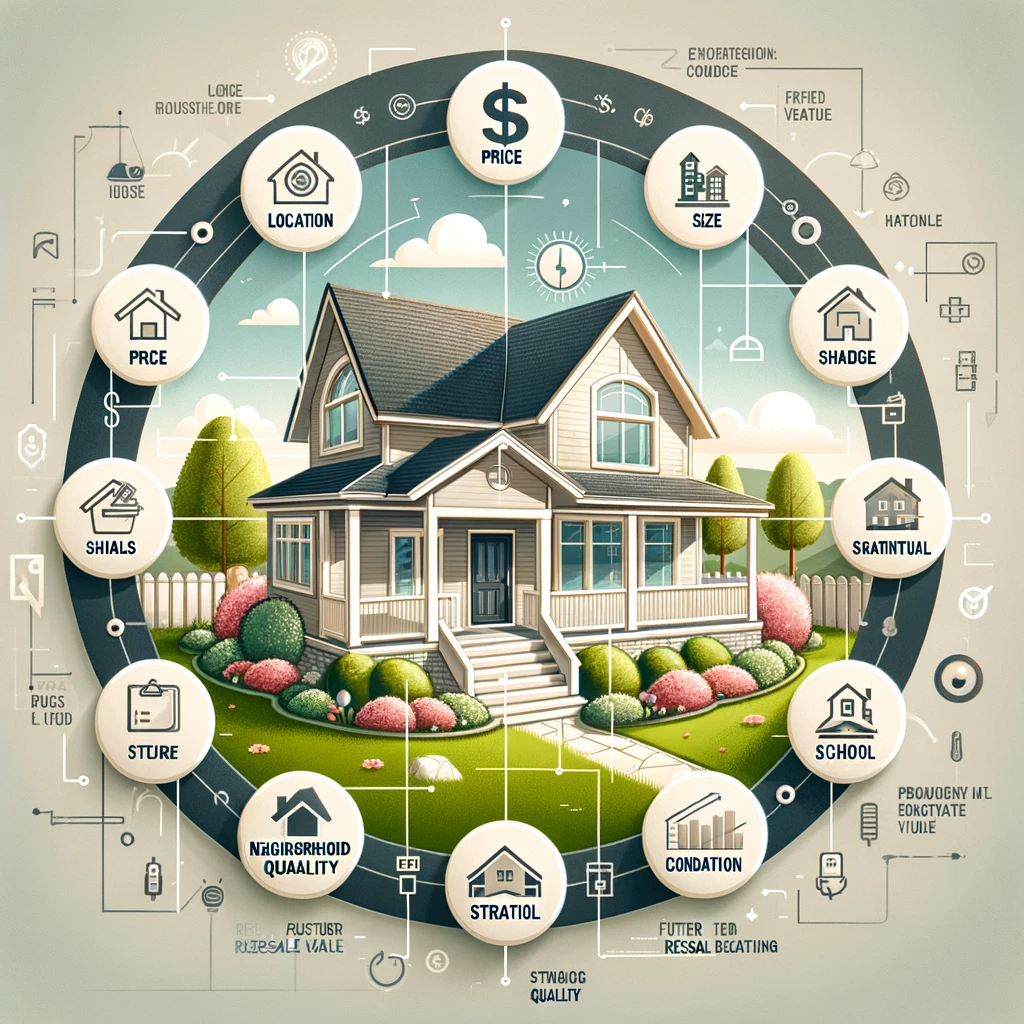

Factors to Consider When Purchasing a Single-Family Home

Buying a house is a significant milestone and a dream for many. However, this decision involves careful consideration of numerous factors to ensure that you find the right home for your needs and budget. From mortgage rates to property taxes and red flags, this guide will walk you through the essential factors to consider when buying a single-family home.

1. Determine How Much House You Can Afford

Before you start thinking about your dream home, it’s crucial to know how much you can afford. Analyze your financial situation, including your income, expenses, and existing debt, to calculate a realistic budget for your home purchase. Mortgage calculators can help you estimate your monthly mortgage payments based on different interest rates and down payment amounts.

2. Location Matters

Location is a fundamental factor to consider when buying a home. Consider how close the property is to your workplace, schools, public transportation, and essential amenities like grocery stores and healthcare facilities. It’s also essential to research the real estate market in the area to understand property values and trends.

3. Property Taxes and Utility Costs

Property taxes can vary significantly depending on the location and value of the property. Be sure to factor in property tax expenses when determining your budget. Additionally, consider the utility costs associated with the home, such as electricity, water, and gas. Energy-efficient homes may have lower utility bills in the long run.

4. Number of Bedrooms and Bathrooms

Consider how many bedrooms and bathrooms you need for your family’s size and lifestyle. This is an important consideration, as the home’s layout should meet your immediate needs and any future plans you may have.

5. Red Flags When Buying

During your home search, keep an eye out for red flags that may indicate potential issues with the property. These can include signs of water damage, structural problems, or hidden defects. A thorough home inspection by a qualified home inspector is essential to uncover any hidden issues before making your decision.

6. Mortgage Rates and Monthly Payments

Stay informed about current mortgage rates and how they can affect your monthly mortgage payments. Lower interest rates can significantly impact your overall affordability, potentially allowing you to buy a more expensive home while maintaining the same monthly budget.

7. Home Maintenance and Upkeep

Consider the level of home maintenance and upkeep required for the property you’re interested in. Older homes may need more frequent repairs and renovations, which can add to your long-term expenses. Assess your willingness and ability to handle home maintenance tasks.

8. House Hunting and Real Estate Agents

House hunting can be an exciting yet overwhelming process. Enlisting the help of an experienced real estate agent can make your search more manageable. Real estate agents have in-depth knowledge of the local market, can identify suitable properties, and negotiate on your behalf.

9. Home Value and Investment Potential

Think about the long-term investment potential of the home you’re considering. Look for factors that could increase the value of the property over time, such as proximity to popular areas, good schools, and future developments in the neighborhood.

10. Avoid Becoming “House Poor”

Don’t overextend yourself financially when buying a home. Being “house poor” means you’re spending a large portion of your income on housing expenses, leaving little room for other financial priorities. Make sure your monthly mortgage payment is manageable and won’t put a strain on your finances.

11. Personal Preference and Future Plans

Remember that choosing a home is a matter of personal preference. Consider your current lifestyle, as well as any future plans or changes in your family’s size. The right home should accommodate your needs and provide a comfortable living environment.

12. Get a Good Deal

Even if you don’t consider yourself a seasoned negotiator, it’s a good idea to try to get a better deal when buying a home. Be prepared to make an offer that reflects the value of the property and any necessary repairs or upgrades.

In conclusion, purchasing a single-family home involves many factors to consider, ranging from financial considerations to the property’s condition and location. By keeping these important things in mind and conducting thorough research, you can make an informed decision that ensures your new home meets your needs and becomes a valuable investment over time. Don’t rush the process; take your time to find the right home for you and your family.